Proper allocation of expenses between those that are currently deductible and those that are required to be capitalized is grounded on the "origin of the claim" doctrine. In the case of a transaction involving the acquisition of an ownership interest in an entity, courts have found that costs that are incurred in the process of these transactions generally produce significant long-term benefits to the entity being acquired or to the party acquiring the entity and, thus, must be capitalized. A cost that is otherwise deductible may not be immediately deducted if it is considered a "capital expenditure" - a cost that yields future benefits to the taxpayer’s business. Section 162(a) generally allows a current deduction for ordinary and necessary business expenses incurred in a taxpayer’s trade or business. 2 General Rules for Allocation of Transaction Costs This article provides a general overview of certain circumstances when capitalized costs can be recovered and discusses the IRS’s view of certain recovery theories under section 165 as summarized in an LB&I Transaction Unit issued on April 30, 2019. However, some costs can still be deducted. Even with a detailed allocation and a finding that many costs can be treated as nonfacilitative of a transaction, a taxpayer will still find that a significant amount of the transaction costs incurred will be required to be capitalized. The allocation must be based on a review of the relevant services provided, the timing of the services, and applicable law addressing the tax treatment of the services. 1 An allocation of transaction costs that treats certain costs as other than capitalized can be supported if such an allocation is made before filing the tax return.

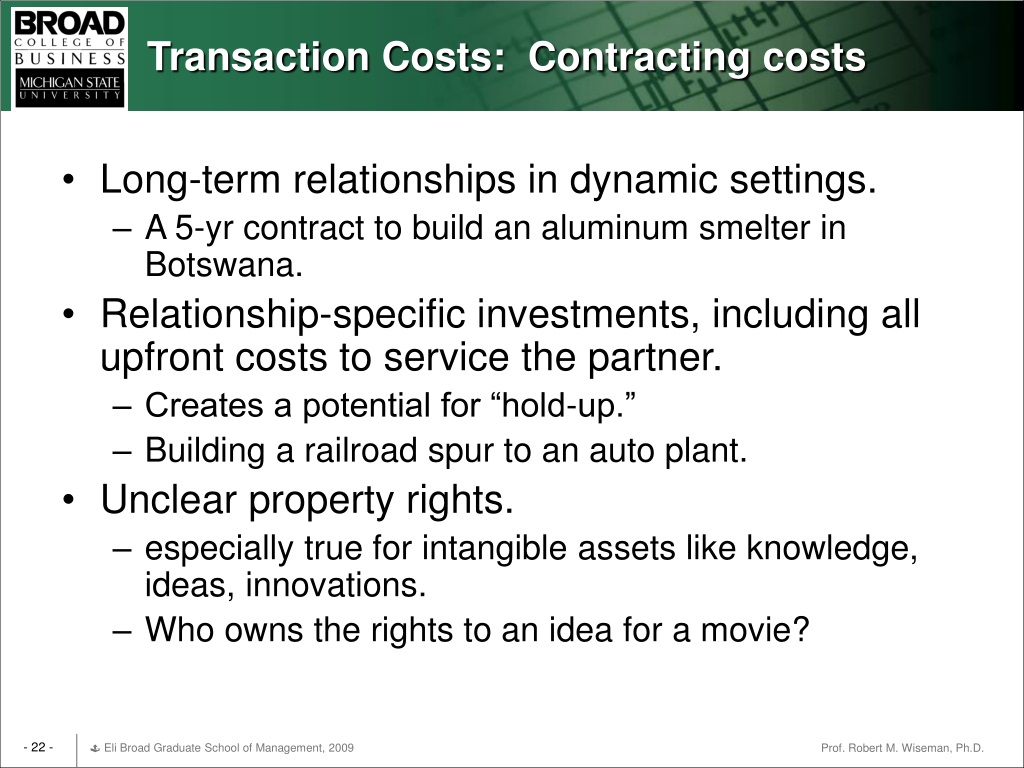

The default rule under section 263 is that all transaction costs that facilitate a transaction must be capitalized. Image: Kaplan Financial Knowledge Bank, Transaction cost theory, at, accessed 1 June 2017.Taxpayers typically incur significant transaction costs when undergoing a transaction involving a restructuring, acquisition, disposition, sale of assets, or sale of stock.

Page created by: Ian Clark, last modified 1 June 2017. Wikipedia, Transaction cost, at, accessed 1 June 2017, referencing Dahlman, Carl J. The Economist, Transaction costs, Economics A-Z, at, accessed. Policing and enforcement costs are the costs of making sure the other party sticks to the terms of the contract, and taking appropriate action (often through the legal system) if this turns out not to be the case.”Įxternalities (core topic) in Economic Analysis and Atlas102 Economic Analysis.On asset markets and in market microstructure, the transaction cost is some function of the distance between the bid and ask. In game theory this is analyzed for instance in the game of chicken.

Bargaining costs are the costs required to come to an acceptable agreement with the other party to the transaction, drawing up an appropriate contract and so on.Search and information costs are costs such as in determining that the required good is available on the market, which has the lowest price, etc.Wikipedia references Carl Dahlman (below) in noting that transaction costs “can be divided into three broad categories: If these costs can be reduced, the price mechanism will operate more efficiently The Economist defines transaction costs as the costs incurred during the process of buying or selling, on top of the price of whatever is changing hands. … a core term used in Economic Analysis and Atlas102 Concept description

0 kommentar(er)

0 kommentar(er)